In digital terms, 2025 was evolutionary rather than revolutionary for primary care. The focus stayed on access and on making access routes work properly for patients, particularly online consultations, telephony and practice websites.

From October, online consultation routes were mandated to be available throughout core practice hours, removing remaining local discretion over when they could be switched on or off.

Uptake of the NHS App continued to increase, though there was plenty of variation across the country. At the same time, AI moved from talking point to day-to-day reality in large parts of primary care, driven mainly by ambient voice technology and robotic process automation.

Using our data analytics platform EDGE, which brings this together digital datasets across practices, PCNs and ICBs to view comparisons and trends over time, I’ve looked at what 2025 actually looked like in practice.

Online Consultations

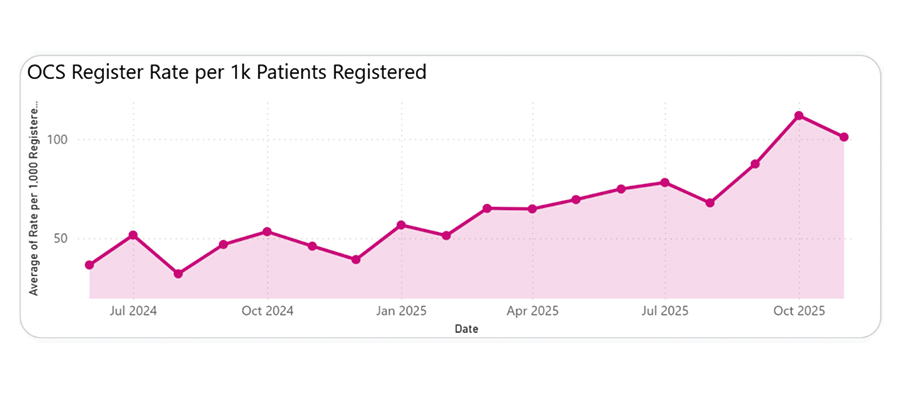

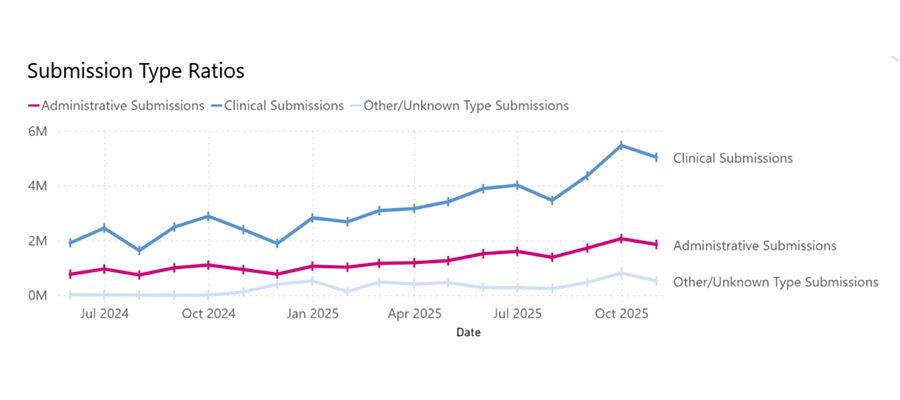

Online consultations continued to scale through 2025, with usage rising sharply in the second half of the year. Monthly submissions increased from around six million in July to roughly seven million by November, while average use rose from about 78 to just over 100 submissions per 1,000 patients. Compared with November 2024, overall volume more than doubled, from around three million to seven million submissions.

The mix of requests also shifted as the year went on. Clinical submissions grew faster than administrative ones, widening the gap between the two. This is broadly what would be expected. Practices that are less confident with online consultations tend to start by limiting use to administrative requests. As confidence grows, clinical submissions are turned on for an increasing number of appointment requests. The steady rise in clinical submissions through mid-2025 suggests many practices were already moving in that direction before the October deadline, with the autumn increase reinforcing online consultation as a routine clinical access route.

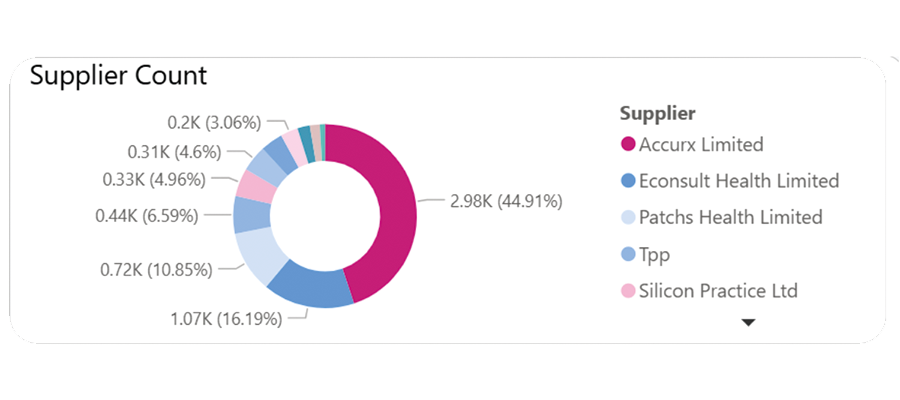

Supplier coverage for online consultation systems barely shifted during 2025. By November, Accurx remained the dominant platform, used by just under half of practices, with eConsult still the second most common choice, covering roughly a quarter. Patches and a small number of other providers made up the remainder. Compared with November 2024, there was little evidence of switching, with most areas sticking with existing suppliers. That stability reflects the wider procurement backdrop. With the Digital Pathways framework suspended in early 2024 and no replacement in place, many ICBs have defaulted to contract renewals, reinforcing incumbent positions despite an increasingly crowded & frustrated supplier market.

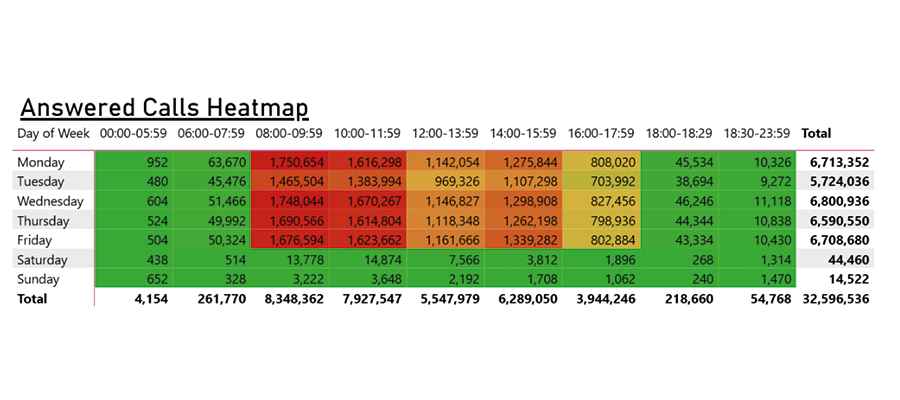

Telephony

While online consultations continued to grow through 2025, the phone remained the dominant access route for most patients. What changed during the year was not its role, but the visibility of the pressure it carries.

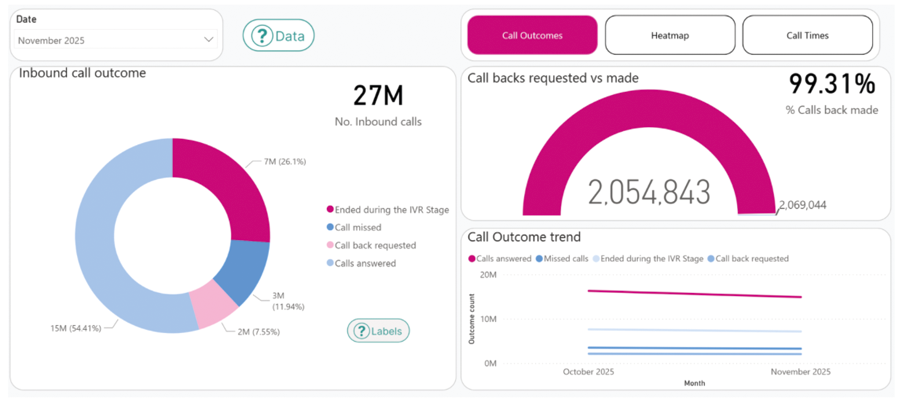

Practices received around 27 million inbound calls in a single month in November, with just over half answered directly, compared to just 7 million online consultation submissions. A further quarter of calls ended before the patient spoke to a person, around 12 percent were missed, and the remainder resulted in callback requests.

Callback completion rates were high, with over 99 percent of requested callbacks made, but that does not reduce the underlying workload. It shifts it. The volume of calls alone confirms that telephony remains the primary front door, even as digital routes expand.

Timing data reinforces this. Call demand was heavily concentrated in weekday mornings, mirroring online consultation patterns. Most calls were relatively short, but the cumulative handling time was substantial. The pressure point was not call length, but call volume arriving in narrow time windows.

The relationship between digital access and telephony in 2025 is therefore not one of substitution. Online consultations absorbed additional demand and provided alternative routes, but they did not materially reduce reliance on the phone.

As with online consultations, variation stands out. Some systems handled significantly higher call volumes per patient than others, with different answer rates and call outcomes under similar conditions. The data makes clear that telephony performance is shaped as much by configuration and workflow as by overall demand.

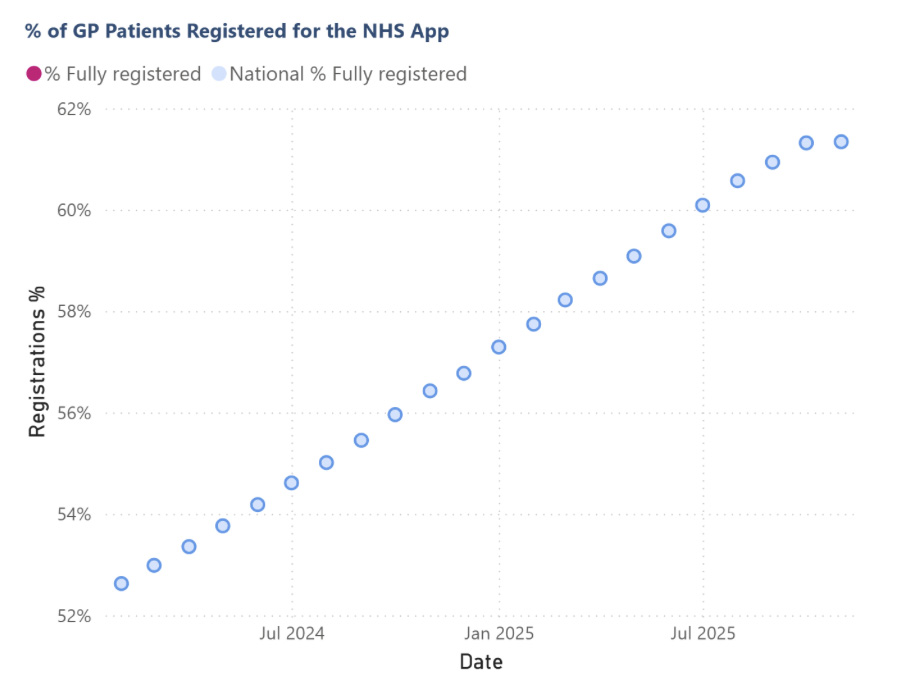

NHS App: uptake up, usage uneven

Uptake of the NHS App continued to increase through 2025, pushing overall registration from 57% at the start of the year to 61.3% by November 25. That represents steady progress, but registration alone only tells part of the story.

Usage remains uneven and task-specific. GP Survey data shows that a large proportion of patients still report not having used the App to contact their practice at all. Even in 2025, “haven’t tried” remains the single largest response category. Where the App is used, it is most commonly for repeat prescriptions and record access, with more variable use for appointments or direct contact.

This pattern suggests the App is now well established as a transactional tool, but less consistently used as a front door for access. That aligns with what practices see operationally: tasks with clear outcomes travel well through the App, while anything that feels uncertain or time-sensitive still defaults to the phone or online consultation.

As elsewhere, variation matters more than averages. Some systems show much higher reported use and confidence than others, despite working within the same national framework. Differences appear to be driven less by the App itself and more by how clearly it is positioned alongside websites, online consultations and telephony.

In 2025, the NHS App continued to grow in reach. Turning that reach into routine behaviour remains the harder part. Read our blog for information on how we helped different areas to improve NHS App utilisation.

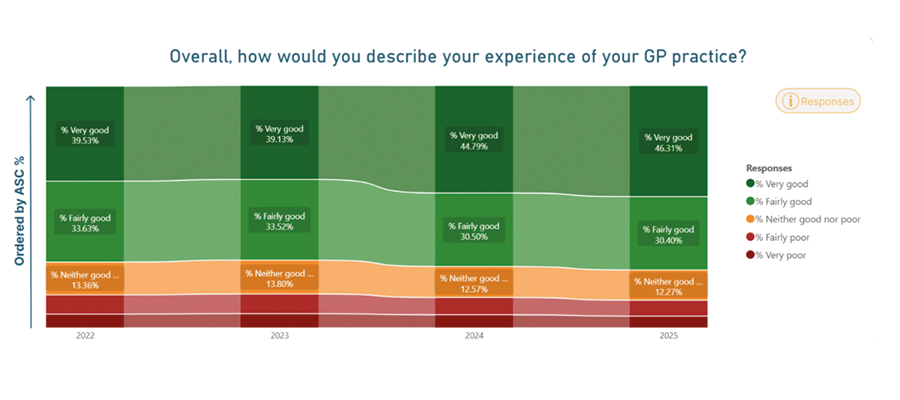

Experience and outcomes: broadly stable, with familiar fault lines

Alongside access routes, the other national datasets from 2025 paint a relatively consistent picture of patient experience and outcomes.

GP Survey results show modest improvement at the headline level. The proportion of patients reporting a “very good” overall experience of their GP practice increased again in 2025, continuing a gradual upward trend. This improvement sits alongside ongoing access pressure and high phone demand, suggesting that experience is being shaped by factors beyond speed of contact alone, including communication, expectation-setting and continuity.

That said, the same survey data highlights persistent weaknesses. A large proportion of patients continue to report difficulty getting through on the phone, and continuity remains mixed. Only a minority say they always or almost always see their preferred healthcare professional, with “sometimes” remaining the most common response. These patterns changed little over the year.

Friends and Family Test results tell a similar story. Scores remain broadly stable, clustered around the middle of the distribution, with no sign of a system-wide deterioration but little evidence of a step-change improvement either. Variation between practices and systems remains more striking than movement in national averages.

Clinical outcomes show the same stability. QOF achievement remains high across the system, with only small year-on-year shifts. This suggests that, despite sustained access pressure and changing ways of working, core clinical delivery has been maintained.

Taken together, these datasets point to a system under strain but encouragingly not in decline. Experience has held up, outcomes remain strong, and the biggest differences continue to be variation between places rather than over time.

Looking at the data properly

Taken together, the data from 2025 points to a system that is evolving unevenly. Online consultations scaled, telephony remained central, uptake of digital tools continued, and patient experience held up better than might be expected given the pressure. At the same time, differences between practices, PCNs and ICBs were often larger than year-on-year national change.

These patterns only become clear when datasets are looked at together rather than in isolation. That’s the approach taken using our data analytics platform EDGE, which brings national metrics together and allows them to be viewed by practice, PCN and ICB, and tracked across time.

We’ll be exploring this joined-up view in more detail in an upcoming webinar: